44 government zero coupon bonds

How to Invest in Zero-Coupon Bonds - US News & World Report Zero-coupon bonds live in the investing weeds, easily ignored by ordinary investors seeking growth for college and retirement. Even fixed-income investors may pass them by, because they don't... Govt's capital infusion via zero coupon bonds positive for ... With the zero coupon bonds, the banks will not benefit from that income. Since FY18, the government has used recapitalisation bonds with banks subscribing to them with a maturity ranging between 10 and 15 years, and coupon rates of 7.4 per cent-7.7 per cent. The government would then use the funds raised to be infused back in PSBs as equity.

Zero-Coupon Bond - Corporate Finance Institute A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. It is also called a pure discount bond or deep discount bond. U.S. Treasury bills are an example of a zero-coupon bond. Summary A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value.

Government zero coupon bonds

Zero Coupon Bonds India- Invest in Zero Coupon Bonds A zero coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Yields Curve - World Government Bonds The United States 10Y Government Bond has a 2.995% yield. 10 Years vs 2 Years bond spread is 37 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United States credit rating is AA+, according to Standard & Poor's agency. How Do I Buy Zero Coupon Bonds? - The Nest Buy municipal zero coupon bonds from the state or city where you live to avoid paying federal income tax on the phantom interest. Municipal bonds are issued by the state, county or other local government. You can also avoid paying tax on the interest by buying corporate zero coupon bonds that have tax-exempt status.

Government zero coupon bonds. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. That definition assumes a positive time value of money.It does not make periodic interest payments or have so-called coupons, hence the term zero coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Reserve Bank of India Most Government bonds in India are issued as fixed rate bonds. For example - 8.24%GS2018 was issued on April 22, 2008 for a tenor of 10 years maturing on April 22, 2018. Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. Zero-Coupon Bonds: Pros and Cons Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment. How Do Zero Coupon Bonds Work? - SmartAsset Zero coupon bonds can be issued by f inancial institutions, c orporations, and f ederal agencies or municipalities. Some of those bonds are initially issued as zero coupon bonds. Others become zero coupon bonds only after a financial institution strips them of their coupons and repackages them. And you still pay taxes on the money you earn from ...

Zero-Coupon Bond: Formula and Excel Calculator Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a "T-Bill," a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Zero-Coupon Bond Price Formula Zero Coupon Bond - Investor.gov Zero Coupon Bond | Investor.gov Zero Coupon Bond Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. RBI orders five banks to list zero coupon bonds at "fair ... A zero-coupon bond is not an interest bearing security. Unlike other bonds, it does not pay interest regularly. These are issued at deep discounts to their face value and are redeemed at face value on the maturity date. For example, a Rs 100 face value bond maturing in 10 years could be issued at Rs. 55. What are Zero Coupon Bonds? - Civilsdaily The government has used financial innovation to recapitalize a bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds called Zero-Coupon Bonds. Try this PYQ: Q.Which of the following is issued by registered foreign portfolio investors to overseas investors who want to be part of the Indian stock market without registering ...

Yields Curve - World Government Bonds The United Kingdom 10Y Government Bond has a 2.015% yield. 10 Years vs 2 Years bond spread is 50.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Government - TreasuryDirect 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ... Zero Coupon Bonds - Financial Web Zero coupon bonds are a form of investment that many investors have turned to as part of a diversified portfolio.Zero coupon bonds present a unique spin on the bond investment. Here are the basics of how zero coupon bonds work and how you could utilize them as part of your portfolio. Understanding Zero Coupon Bonds - The Balance Zero coupon bonds generally come in maturities from one to 40 years. The U.S. Treasury issues range from six months to 30 years and are the most popular ones, along with municipalities and corporations. 1 Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value

Government, Zero-Coupon & Floating-Rate Bonds - Study.com Treasury bonds are issued for 30 year terms and have a coupon payment, or interest payment, every six months. Payments continue for the 30 year duration, at which point the government pays the face...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for...

What are zero coupon bonds? - The Indian Express Zero coupon bonds: The funds raised through issuance of these instruments, which are a variation of the recapitalisation bonds issued earlier to public sector banks, are being deployed to capitalise the state-run bank. The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of ...

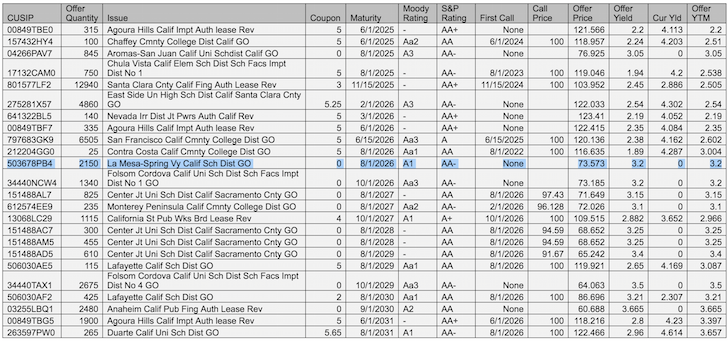

Table 1 shows the current market prices for two | Chegg.com Transcribed image text: Table 1 shows the current market prices for two zero-coupon government bonds. The par value for both bonds is €100.- Use the information in table 1 to calculate the one-year, one-year forward rate. Table 1. Zero-coupon bond prices and implied spot rates.

Advantages and Risks of Zero Coupon Treasury Bonds Zero-coupon government bonds can be purchased directly from the Treasury at the time they are issued. After the initial offering, they can be purchased on the open market through a brokerage...

Government won’t sell zero-coupon bonds to Bank Indonesia: Sri Mulyani - Business - The Jakarta Post

Zero Coupon Bond - InvestingAnswers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero Coupon Bond - WallStreetMojo Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn't involve any cash flow during ...

Not All Bonds Are Created Equal: Choosing Between Individual Bonds and Bond Funds - Hennion & Walsh

What are Zero coupon bonds? - INSIGHTSIAS What are Zero coupon bonds? Context: The government has used financial innovation to recapitalise Punjab & Sind Bank by issuing the lender Rs 5,500-crore worth of non-interest bearing bonds valued at par. These are special types of zero coupon bonds issued by the government after proper due diligence and these are issued at par.

Post a Comment for "44 government zero coupon bonds"