44 coupon on a bond

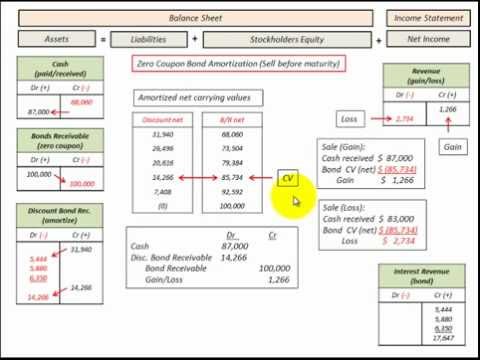

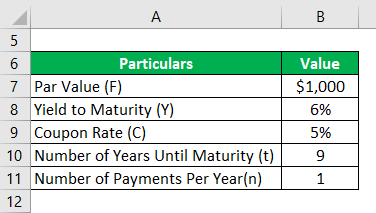

bead & bond US Coupons, Promo codes | September 2022 Specials Yes! We are currently offering Up to 1% Cash Back when you shop at bead & bond US! We currently have 0 offers and coupons from bead & bond US. You're Browsing In Home bead & bond US Coupons Works at thousands of stores Automatically applies coupons Earn Up to 1% cash back on bead & bond US! . Please review the , and if you have any questions. Bond Formula | How to Calculate a Bond | Examples with Excel … Step 1: Initially, determine the par value of the bond and it is denoted by F. Step 2: Next, determine the rate at which coupon payments will be paid and using that calculate the periodic coupon payments. It is the product of the par value of the bond and coupon rate. It is denoted by C and mathematically represented as shown below.

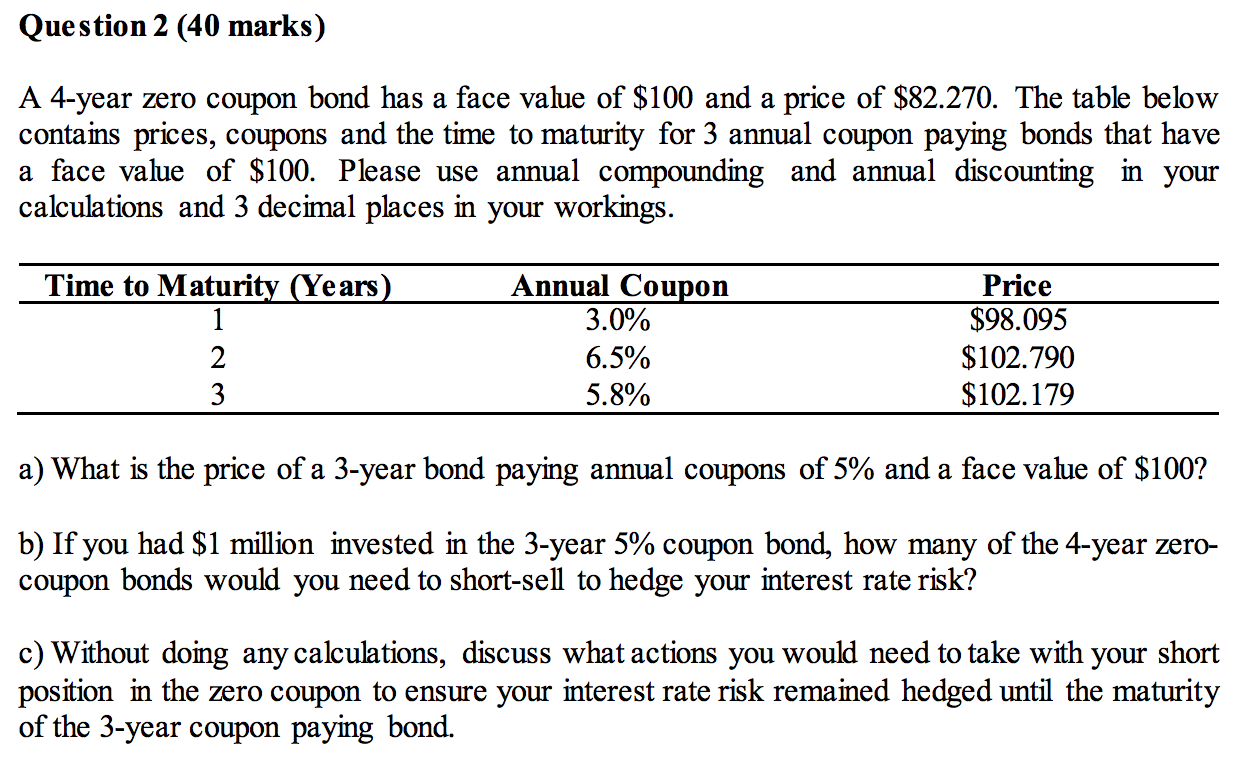

Coupon Bearing Bonds vs. Zero Coupon Bonds - BrainMass The YTM on either bond issue will be 7.5%. The coupon bond would have a 6.5% percent coupon rate. The company's tax rate is 35%. These are 20 year bonds. 2. How many of the coupon bonds must East Coast issue to raise the $50 million? 3. In 20 years, what will be the principal repayment due if East Coast Yachts issues the coupon bonds?

Coupon on a bond

UCB Investment announces Tk 3000m zero coupon bond 26 September, 2022 12:00 AM. Print news. Closing ceremony of DBH Zero Coupon Bond worth Tk 3000 million was held on Thursday at Banani in the capital. UCB Investment Limited - one of the leading and fast-growing investment banks in the country is the arranger of this issuance, said a press release. Government bond yields soar as markets weigh threat of a recession On the bond side, advisors watch so-called duration, or measuring bonds' sensitivity to interest rate changes. Expressed in years, duration factors in the coupon, time to maturity and yield paid... India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.294% yield.. 10 Years vs 2 Years bond spread is 27.3 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

Coupon on a bond. ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF - ETF.com It tracks an index of long-term Treasurys with coupon cash flows removed, leaving only the principal repayment at the end. Called STRIPs, these securities are sold at deep discount to face value... Bond Price Calculator | Formula | Chart 20/06/2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the following … Treasury Bonds Rates - WealthTrust Securities Limited Unlike a T-Bill, the holder of a T-Bond will be entitled to semi-annual periodic interest payments (coupon interest) which are paid at a predetermined fixed rate and a date during the life of the T-Bond. Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 ... Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing September 24th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today.

APPLE INC.DL-NOTES 2021(21/41) Bond | Markets Insider The Apple Inc.-Bond has a maturity date of 2/8/2041 and offers a coupon of 2.3750%. The payment of the coupon will take place 2.0 times per biannual on the 08.08.. At the current price of 72.023 ... What is the difference coupon rate and yield rate? bonds market coupon rate investment retail investors yield rate. Answer. Investing in Bonds Online in India | HDFC Securities CONVERTIBLE BONDS The bond holder has the option to convert these types of bond into equity on pre-specified terms. RBI Bond Government of India has announced to launch Floating Rate Savings Bonds, 2020 (Taxable) scheme commencing from July 01, 2020 to enable Resident Indians/HUF to invest in a taxable bond, without any monetary ceiling. Zero Coupon Stock And Bond - Grades Express Now suppose the bond still pays an annual coupon of $50 but the interest rate drops to 2%. What is the new value of this bond? The XYZ Corporation pays a dividend of $1 for each share and its required rate of return is 8%. Answer the following questions: Assuming zero growth in dividends, what is the value of each share?

Bonds Outlet Coupons, Promo codes | September 2022 Specials Bonds Outlet trending coupons in date('d/m/Y') - 5 Coupons, Promo Codes, & Deals at Bonds Outlet plus Earn Up to 1% Cash Back With Smarty. Yield to Call Calculator | Calculating YTC | InvestingAnswers coupon rate. number of years to the call date. frequency of payments. call premium (if any) current price of the bond. Calculating Yield to Call Example. For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator ... Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Implicit interest for a zero coupon bond - BrainMass Suppose a firm needs to raise $10 million by issuing 10-year zero coupon bonds. The firm's cost of debt is 8%. Compute the total implicit interests ... Solution Summary The expert calculates the implicit interest for zero coupon bonds. $2.49 Add Solution to Cart ADVERTISEMENT

How to Invest in Bonds | The Motley Fool If prevailing interest rates increase, prices for existing bonds are likely to fall because the coupon it offers is less valuable compared to new bonds. With the Federal Reserve aggressively hiking...

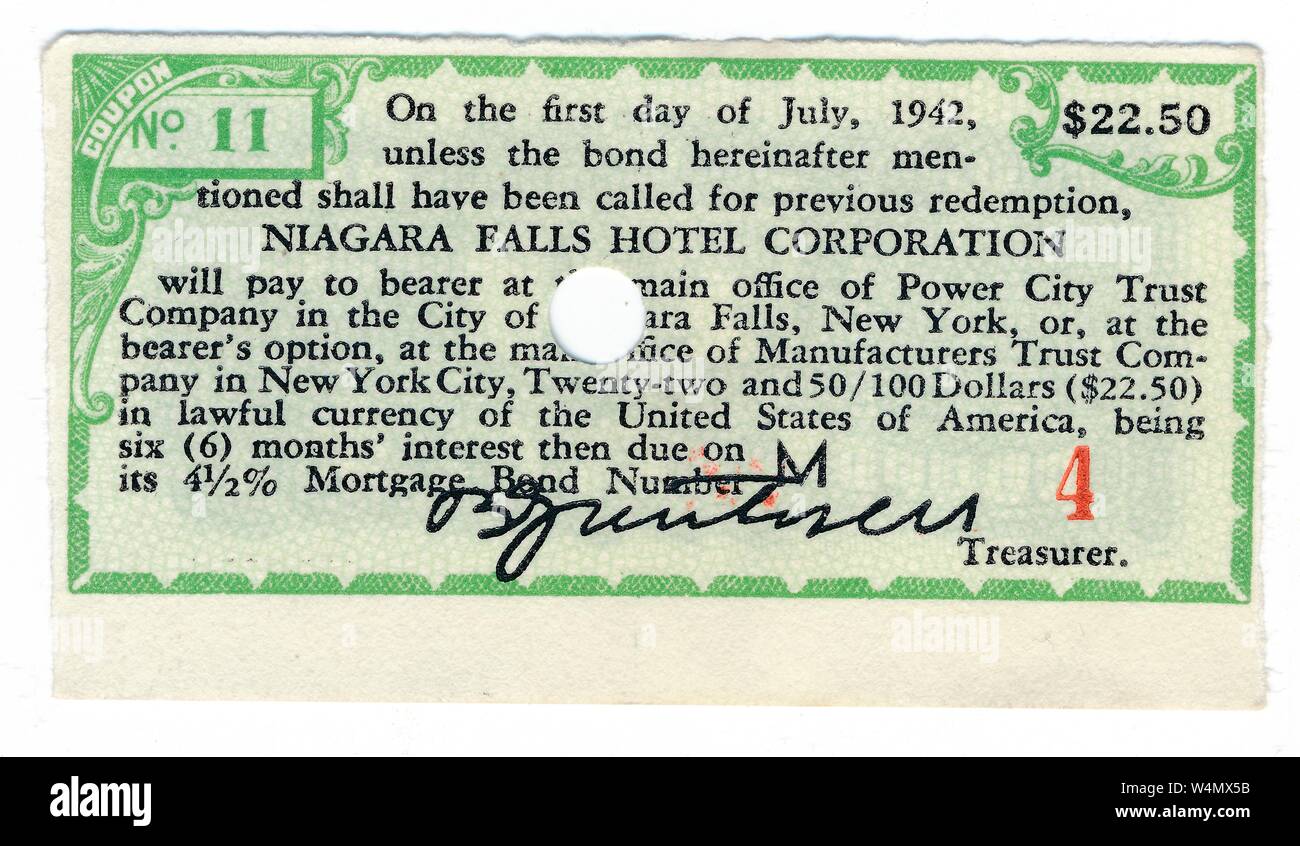

GERMAN BOND 1924 100,000,000 MARKS WITH 8 COUPONS | eBay Find many great new & used options and get the best deals for GERMAN BOND 1924 100,000,000 MARKS WITH 8 COUPONS at the best online prices at eBay! Free shipping for many products!

dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

What Is A Bond? - Bonds Online A bond's coupon rate can be fixed, meaning it pays equal interest payment amounts over the life of the loan, or variable, which means it is determined by a prime rate or an interest rate index. Coupon Date The coupon date states when your interest payments will begin, which the issuer usually pays semiannually.

GERMAN BOND 1924 100,000,000 MARKS WITH 8 COUPONS | eBay Greece 1910 Banque D Orient 125 Francs Gold OR Coupons Bond Titre Loan Share. $165.00 + $12.00 shipping + $12.00 shipping + $12.00 shipping. Chocolat Suchard Chocolate 1924 Stock/Bond Certificate - Bucharest, Romania. $35.00 + $4.00 shipping + $4.00 shipping + $4.00 shipping.

WALMART INC. Bond | Markets Insider The Walmart Inc.-Bond has a maturity date of 8/15/2037 and offers a coupon of 6.5000%. The payment of the coupon will take place 2.0 times per biannual on the 15.02.. At the current price of 117 ...

› glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

United States Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. United States Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

National Notary Association Coupons 2022 - Couponsoar.com Save up to 10% off - 60% off off with National Notary Association Coupon Codes , Discount Codes. Enjoy free valid National Notary Association Coupons & Promo Codes now! 100% verified. 14,282,300 vouchers for 33,035 stores, Updated on Sep 27,22

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Basis Zero-Coupon Bond Regular Coupon Bearing Bond; Meaning: It refers to fixed Income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more security, which is sold at a discount to its Par value and doesn’t involve …

› terms › bBond Discount - Investopedia May 29, 2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

U.S. Treasury Bond Futures Quotes - CME Group US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. ... including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics. View historical fixings for EFFR ...

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Some bonds on secondary market are essentially "Zero-Coupon" bonds With yields rising, many older bonds are selling at a discount but their coupon can be relatively low (e.g 0.9%). With the discounted purchase price the YTW can be much higher (e.g. 3.8%). But the YTW takes into account the fact that you purchased the bond at a cost of less than $1000, and when it's redeemed you will receive $1000.

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Fixing of coupon rates - Nykredit Realkredit A/S Fixing of coupon rates effective from 1 October 2022 Effective from 1 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly...

United Kingdom Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. United Kingdom Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield.

› finance › bond-priceBond Price Calculator | Formula | Chart Jun 20, 2022 · Calculate the coupon per period. To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50.

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

Bond Discount - Investopedia 29/05/2021 · Bond Discount: The amount by which the market price of a bond is lower than its principal amount due at maturity. This amount, called its par value , is often $1,000. As bond prices are quoted as ...

Zero-Coupon Bond - Definition, How It Works, Formula 28/01/2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than …

UCB Investment collects Tk 300cr for DBH Zero Coupon Bond The closing ceremony of the issuing of DBH Zero Coupon Bond worth Tk 3000 million was held on Thursday at Sheraton Hotel at Banani in Dhaka. UCB Investment Limited— one of the leading and fast-growing investment banks in the country is the arranger of this issuance, said a press release.

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a ...

A bond has a coupon rate of 15%, a yield to maturity of 10.55%, and a ... A bond has a coupon rate of 15%, a yield to maturity of 10.55%, and a market price of $850. Therefore, the annual interest payment is: a.) $850 b.) $150 c.) $105.50. d.) $120.0 The post A bond has a coupon rate of 15%, a yield to maturity of 10.55%, and a market price of $850. … appeared first on Empire Essays.

Fixing of coupon rate effective from 1 October 2022 With effect from 1 October 2022, the coupon rate of the following bonds financing RD Euribor3®, RD Stibor3®, RD Stibor3® Green, RD Nibor3®, RD Cibor6® (RO), FlexGaranti® and RenteDyk® will ...

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.294% yield.. 10 Years vs 2 Years bond spread is 27.3 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%.

Government bond yields soar as markets weigh threat of a recession On the bond side, advisors watch so-called duration, or measuring bonds' sensitivity to interest rate changes. Expressed in years, duration factors in the coupon, time to maturity and yield paid...

UCB Investment announces Tk 3000m zero coupon bond 26 September, 2022 12:00 AM. Print news. Closing ceremony of DBH Zero Coupon Bond worth Tk 3000 million was held on Thursday at Banani in the capital. UCB Investment Limited - one of the leading and fast-growing investment banks in the country is the arranger of this issuance, said a press release.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "44 coupon on a bond"