38 coupon vs zero coupon bonds

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax exclusion. About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

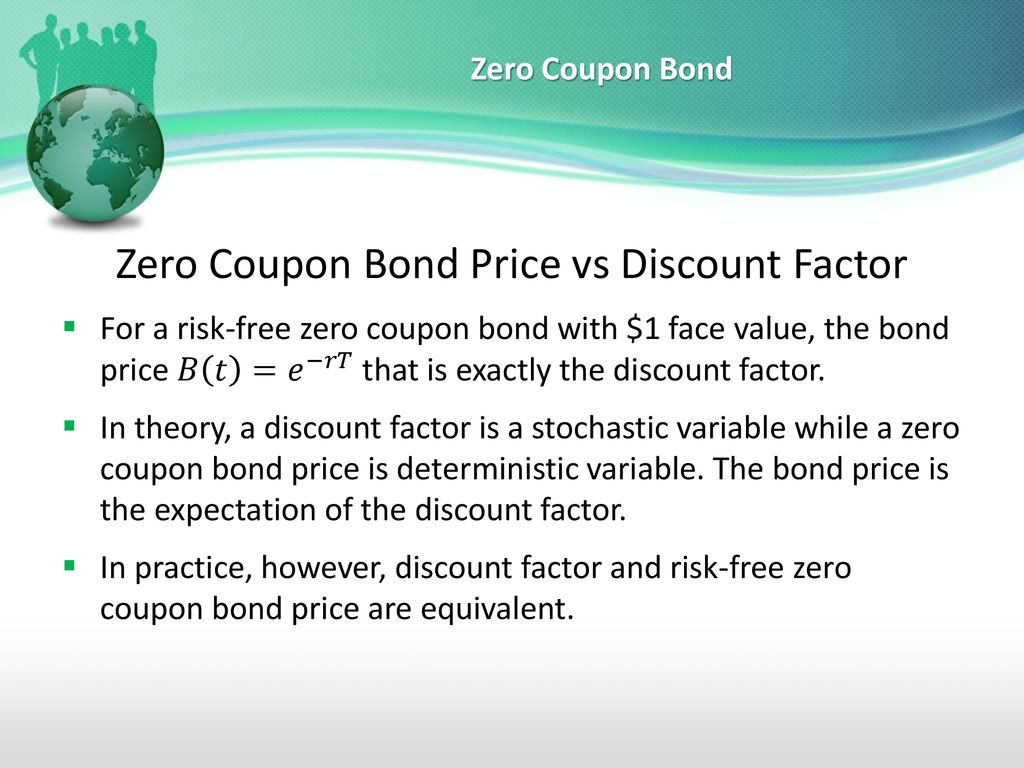

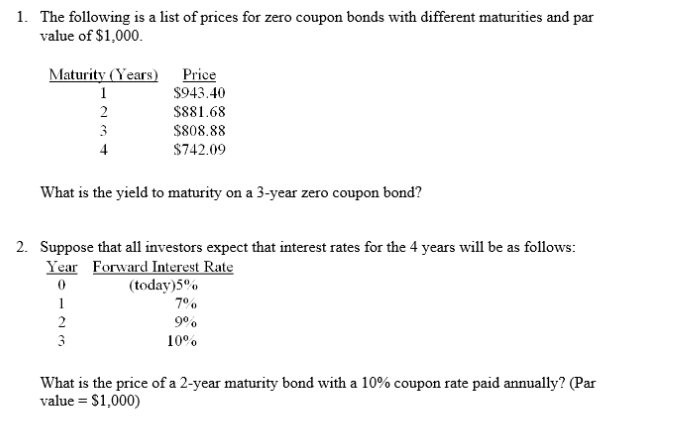

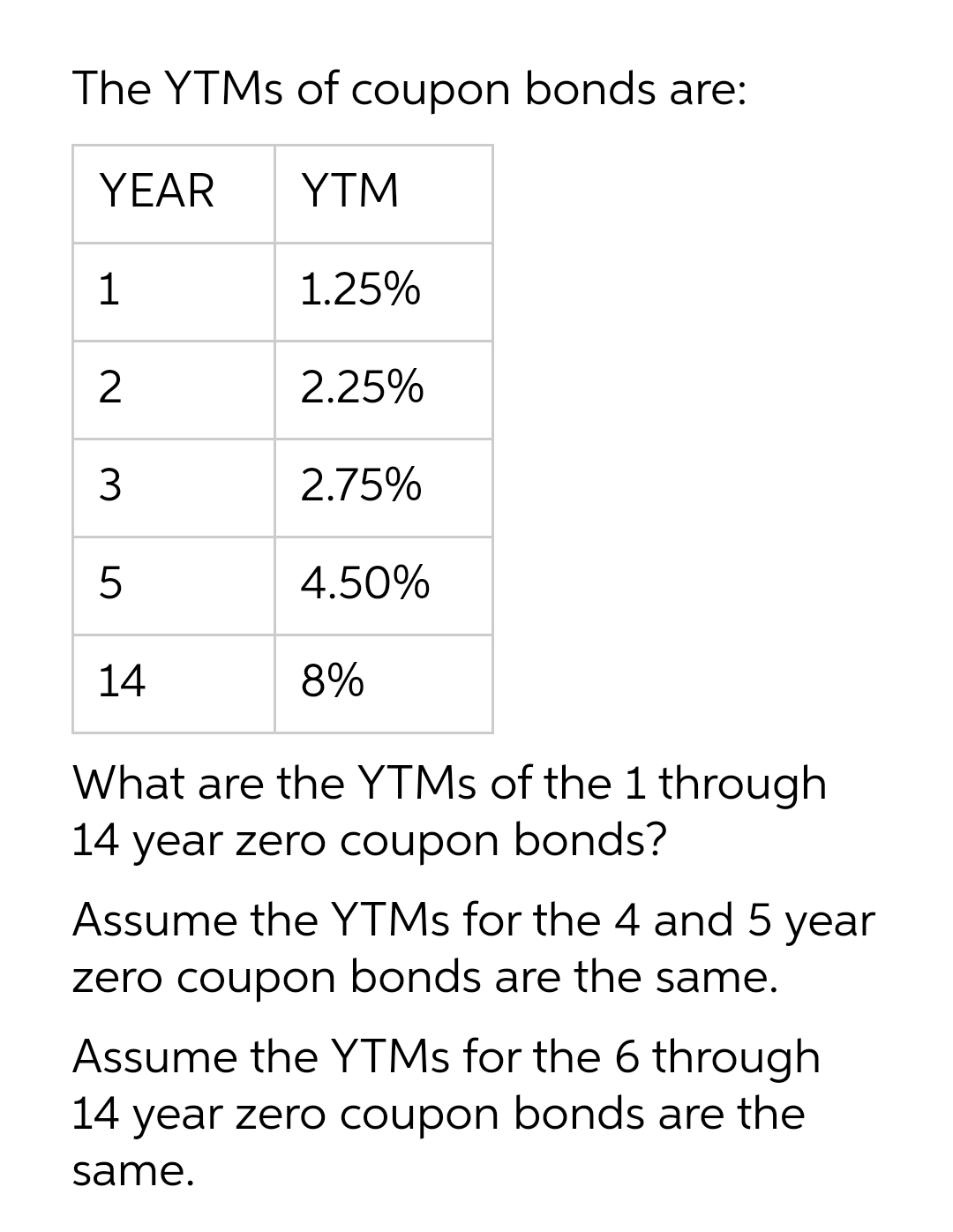

Yield to maturity - Wikipedia Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds. For bonds with multiple coupons, it is not generally possible to solve for yield in terms of price algebraically. A ...

Coupon vs zero coupon bonds

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are … Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31/05/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What are Zero-Coupon Bonds? (Characteristics + Calculator) Zero-Coupon vs. Traditional Coupon Bonds. Unlike zero-coupon bonds, traditional coupon bonds with regular interest payments come with the following benefits: Source of Recurring Income for Bondholder; Interest Payments Derisk the Lending (i.e. Raises “Floor” on Maximum Potential Loss) Consistent, Timely Interest Payments Confirms Credit Health

Coupon vs zero coupon bonds. How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value. As a result, YTM calculations for zero-coupon bonds differ ... Bond (finance) - Wikipedia An example of zero coupon bonds is Series E savings bonds issued by the U.S. government. Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons and the final principal payment of the bond may be traded separately. See IO (Interest Only) and PO … Individual bonds vs a bond fund - Bogleheads 14/06/2019 · The point of using zero coupon bonds is that they are an equally arbitrary option. But they show that Fred is never worse off than Larry: a bond fund is no riskier than a bond ladder. In real life, people should hold bond funds (high grade, short or intermediate term, and a mix of nominal and inflation-adjusted), and just ignore the NAV. All that matters is total return, … Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond. Since they sell at a discount to their stated maturation value they are known as discount bonds. In a falling rate envirnoment zero-coupon bonds appreciate much faster than other bonds which have periodic coupon payments. Bonds with a longer duration are more sensitive to the …

Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · Zero-coupon bonds are also appealing for investors who wish to pass wealth on to their heirs but are concerned about income taxes or gift taxes. If a zero-coupon bond is purchased for $1,000 and ... What are Zero-Coupon Bonds? (Characteristics + Calculator) Zero-Coupon vs. Traditional Coupon Bonds. Unlike zero-coupon bonds, traditional coupon bonds with regular interest payments come with the following benefits: Source of Recurring Income for Bondholder; Interest Payments Derisk the Lending (i.e. Raises “Floor” on Maximum Potential Loss) Consistent, Timely Interest Payments Confirms Credit Health Zero-Coupon Bond: Definition, How It Works, and How To Calculate 31/05/2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are …

Post a Comment for "38 coupon vs zero coupon bonds"